Why we invested in Hyperion Robotics

By Juan Carlos Sanchez,

The construction sector is undergoing a tectonic shift towards embracing innovative solutions to address some of its most profound challenges – chief among them, endemic low productivity, unsafe working conditions and highly pollutive processes. This change in mindset is starting to be deeply rooted in the culture of most organisations within the sector; an element that has impeded technological adoption in the past.

One of the biggest driving factors of technological adoption within construction is the huge pressure that regulators and large capital allocators are exerting to achieve carbon net zero. Representing 6% of global GDP – and generating a staggering 38% of the world's CO2 emissions – the construction sector needs to urgently find better ways to monitor, report, reduce and capture the greenhouse gases it emits. Doing so is rapidly becoming a requirement for building permits and avoiding punitive mitigation penalties. Enabling technologies will become ever more prevalent as the industry tries to support population growth expected over the next 30 years, in parallel dealing with a shrinking workforce, no less.

As a venture capital investor, it is exciting to observe a similar momentum building up around digitisation within construction to what took place in the financial industry almost a decade ago at the outset of the fintech revolution. At that time, most of the main banks and insurance groups decided to finally embrace and invest heavily in digitisation. New and well capitalised corporate innovation units were created and we saw some of the first Corporate Venture Capital units being launched. That process completely transformed the financial sector and generated some of the biggest venture-backed companies to-date. Even though the triggers for change are to a large extent different, a similar activity is now taking place in the construction industry, which makes me bullish on the growth potential of the ConTech space.

With this as the backdrop of our market thesis, we at Goldacre were delighted to invest in the recently announced €3m Late Seed round of Hyperion Robotics, a Finnish-based company that is bringing automation and sustainable practices to the construction industry by leveraging software, 3D printing and low-carbon materials.

From the first day we met Hyperion as part of our scale-up programme, RElab, we were pleased to meet a team with a strong vision and relevant expertise across construction, engineering, software and robotics. These strengths were well complimented by the team’s previous experiences founding and operating venture-backed companies. In Hyperion’s three co-founders, Fernando (CEO), Henry (Head of Engineering) and Ashish (CTO), we have a highly ambitious team capable of attracting strong talent, investors and clients, thanks to their charisma and ability to convey Hyperion’s bold vision in a simple and eloquent way. We have found this combination of skills to be critically important in the ConTech space given the intricacies of the sector.

During our due diligence – and various industry meetings and roundtables we organised with Hyperion and our RElab corporate partners as part of the RElab 2022 programme – we gained strong conviction over the company’s product-market fit potential. Despite being at a fairly early stage, Hyperion’s projects with Iberdrola, Metso Outotec and Techint group are already proving very valuable markers for building the trust that the industry requires when adopting innovative materials, structures and processes.

Hyperion’s early client case studies show how the company’s end-to-end solutions can enable clients to build highly optimised reinforced structures with up to 75% less construction materials, cutting costs by 30%, lead times by 50% and CO2 emissions by up to 90%. The company’s industrialised building process, centred around the use of robotics and software automation, have also led to increased labour safety. This is precisely what the industry is looking for in terms of speed, cost, safety and sustainability.

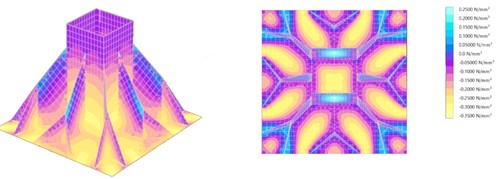

The company is also ahead of many in the way it optimises building structures in order to reduce the amount of materials used. This is something that the sector has not done widely to date, which has often led to unnecessary waste and emissions.

Figure 1: Structural simulation of Hyperion’s foundation

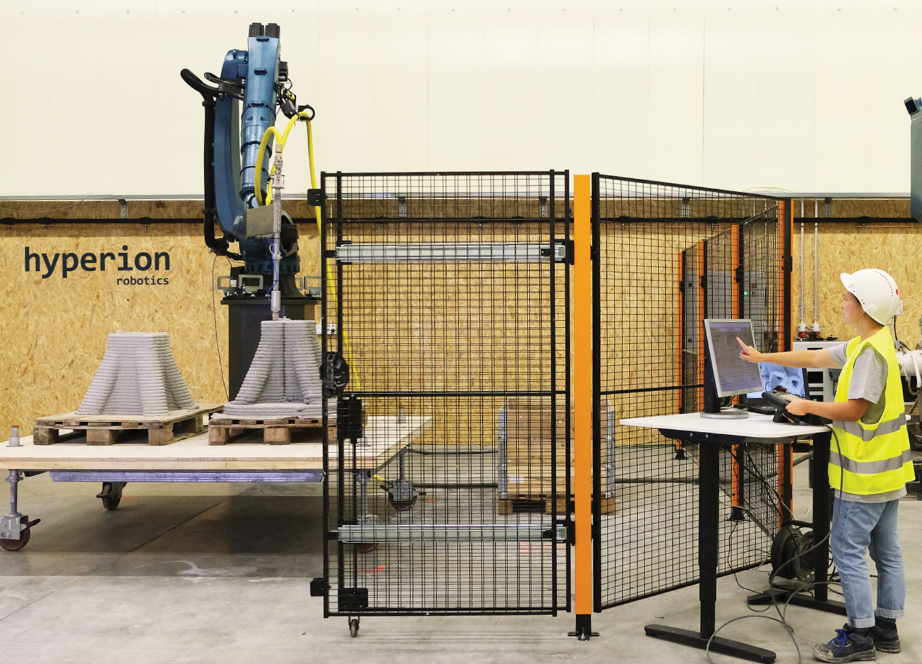

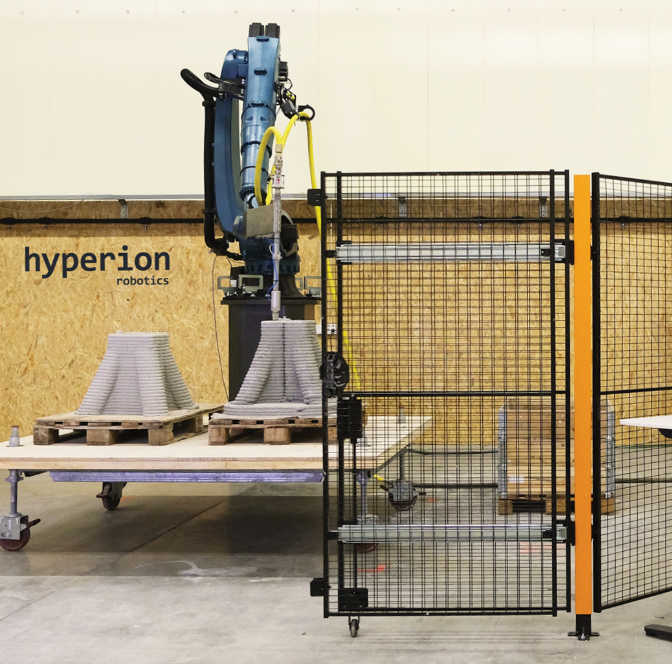

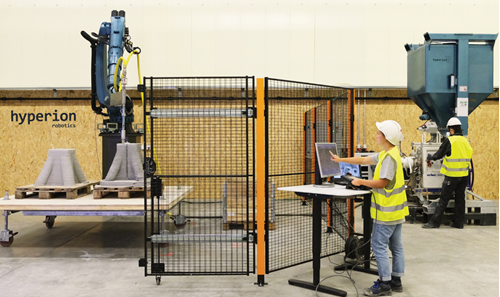

Another competitive advantage relates to their capex-light micro-factories which can be rapidly deployed onsite or offsite, offering mass customisation of tailored elements at competitive pricing without compromising on scalability. Hyperion works with local partners who provide the right industrial set-ups with locally sourced materials, both traditional and recycled. We are particularly excited by these types of models which effectively outsource as much of the operational and capital expenditure requirements upstream to the supply chain, thereby maximising margins and scalability potential while minimising working capital.

Figure 2:Hyperion Micro-Factory

At Goldacre, we are pleased to join Hyperion on this journey and to work alongside a strong group of co-investors including lead investor Lifeline Ventures, climate-tech focused Übermorgen VC, PC Rettig & CO Impact and Katapult to build a more productive and sustainable construction industry.

If you would like to learn more about the company, please see here Fernando’s pitch during our RElab 2022 investor conference.

Juan Carlos Sanchez

Investment Manager

jcsanchez@goldacre.com

Juan Carlos joined Goldacre Ventures at the start of 2018 where he is now an Investment Manager. He is responsible for sourcing, investing and supporting teams with a vision to disrupt the status quo. With over 8 years of experience in venture capital and finance, Juan Carlos has invested in more than 25 companies from Seed to Series C, focusing mostly on B2B tech-enabled businesses. Juan Carlos was awarded a scholarship at the University of Cambridge where he completed an MPhil in Finance. He holds a BA in Economics from the University of Manchester where he graduated top of his class and received several academic awards. In 2019, Juan Carlos was recognised by Brummell Magazine as “30 Ones to Watch in Finance